AFFORDABILITY

Last week on the I’ve Had It podcast, Governor JB Pritzker once again claimed he is fighting to lower taxes for working and middle-class families. Illinois families know that claim simply does not match reality.

Just last year, Democrats in the Illinois General Assembly passed the largest budget in state history, totaling more than $55 billion and including roughly $700 million in new taxes.

According to the Illinois Policy Institute, Illinois is now taking $1,434 more in taxes from each resident than before Governor Pritzker took office. Compared to his first year in 2019, the state is collecting $18 billion more from taxpayers, an increase of 51 percent that far outpaces inflation.

And if that were not enough, Governor Pritzker has doubled down on unreliable green energy policies that are driving utility costs even higher. Earlier this year, he signed a green energy giveaway projected to saddle Illinois families with an estimated $8 billion rate hike.

So how can the Governor claim he is lowering costs for the middle class when Illinois ranks:

- #1 for highest property taxes

- #1 for highest combined state and local taxes

- #1 for highest cell phone taxes

Last year, WalletHub even ranked Illinois as the worst state in the nation for taxpayers because of its excessive tax burden.

So, despite the repeated claims from Governor Pritzker, the math just does not add up.

CAMPFIRE TAX

Illinois Democrats, aka the proprietors of the ‘Bad Idea Factory,’ are at it again with a new proposed tax. This time they’re trying to tax your campfires! HB 4459, proposed by Rep. Amy Briel (D), would force you to get a permit and pay up to $5 every time you light a backyard fire pit, roast marshmallows, or enjoy a simple campfire with family and friends.

It’s sold as “supporting fire protection,” but it’s just another fee on everyday fun, with massive fines up to $100,000–$500,000 for violations. No wonder Illinois taxes are so high – Illinois Democrats want to tax everything, including your backyard fire pit.

PENSIONS AND UNFUNDED MANDATES

In Illinois, we have to get serious about our pension crisis and rolling back the unfunded mandates we’ve pushed onto local communities that drive their costs up. For example, the spiral of bad policy involves a new law forcing compliance by a local government.

This action has financial impacts, but there is no additional funding or compensation being offered by the state. In turn, the local governing body passes that financial burden onto its residents, often in the form of higher property taxes.

These unfunded mandates and public pension liabilities are crushing Illinois families. Learn more here: Unfunded mandates keep property taxes high

EDUCATION

Students in Illinois could soon benefit from federal scholarship funds to help them find a tutor, attend a different school, or help with their curriculum. The scholarship funds will benefit and provide academic support to both public and private school students. However, the final decision rests with Governor Pritzker. It’s time to put students and their futures first, Governor, and opt in to this great program being funded by the federal government.

Learn more here: Donors can help Illinois students, but will Pritzker let them?

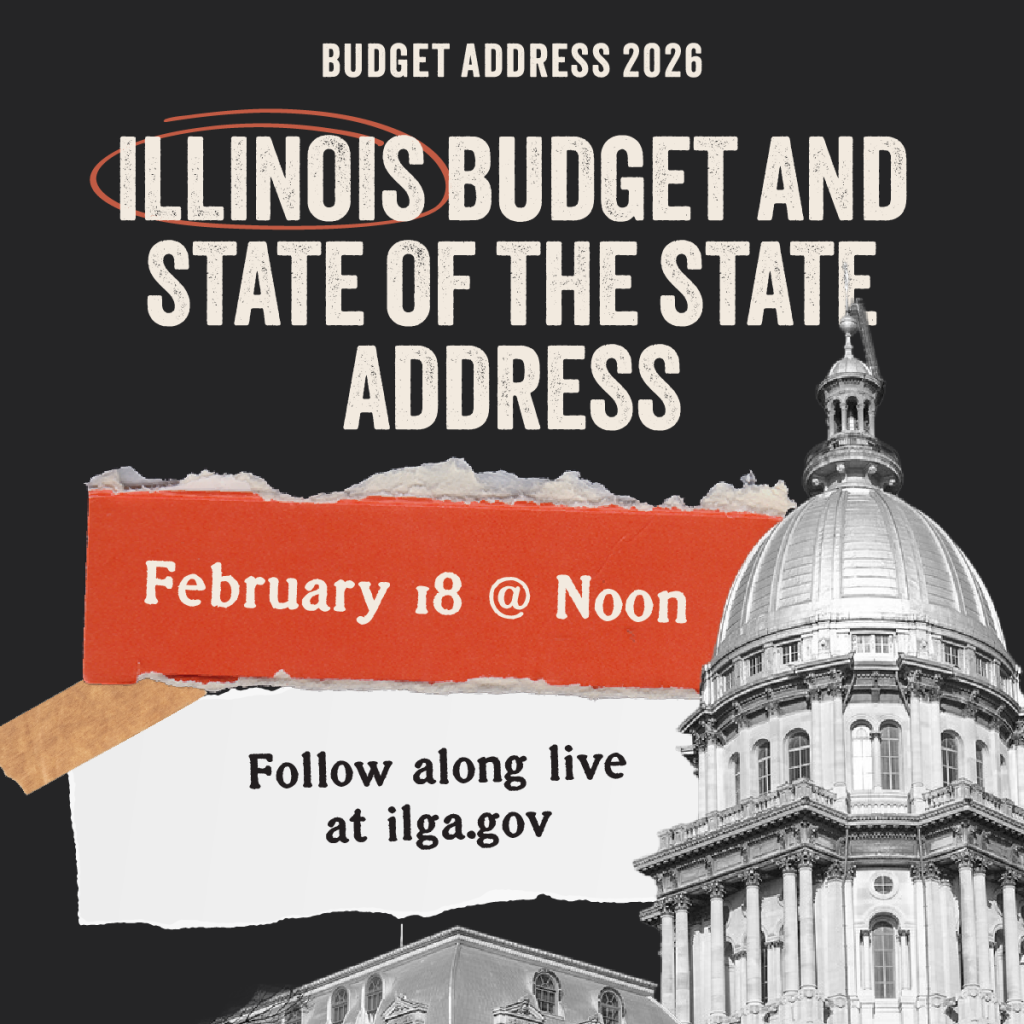

BUDGET ADDRESS

The combined Illinois Budget and State of the State Address will take place in Springfield on Wednesday, February 18 at noon. You can watch the Governor’s speech live here: Illinois General Assembly – Live Audio & Video